In recent years many companies have expanded their open innovation initiatives, with universities capturing the spotlight as an invaluable source of new technologies and game-changing breakthroughs. However, as part of a global web of science and innovation, it can be difficult for academics to get their research in front of the right people in industry. Attracting interest from relevant research and development (R&D) professionals, who often have limited time to evaluate each academic discovery that lands on their desk, is a challenge. Effectively communicating science to industry is crucial to the successful commercialisation of university research.

Originally posted on the IN-PART website

What information do R&D teams look for in a project summary?

In most cases, translating an academic breakthrough into a new product, medicine or technological solution can’t be done without collaborating with industry. In universities, the office of technology transfer (TTO) or research commercialisation (ORC) will be tasked with the responsibility for making sure the right people in industry are alerted to relevant discoveries.

Getting the attention of R&D professionals involves cleverly packaging up complex scientific ideas and inventions into easily-digestible summaries. These project summaries, also known as technology disclosures, are designed so that an R&D professional can conduct a quick initial review to assess first, whether it’s relevant to their current research priorities, and then second, if it presents a unique solution to one of their R&D requirements.

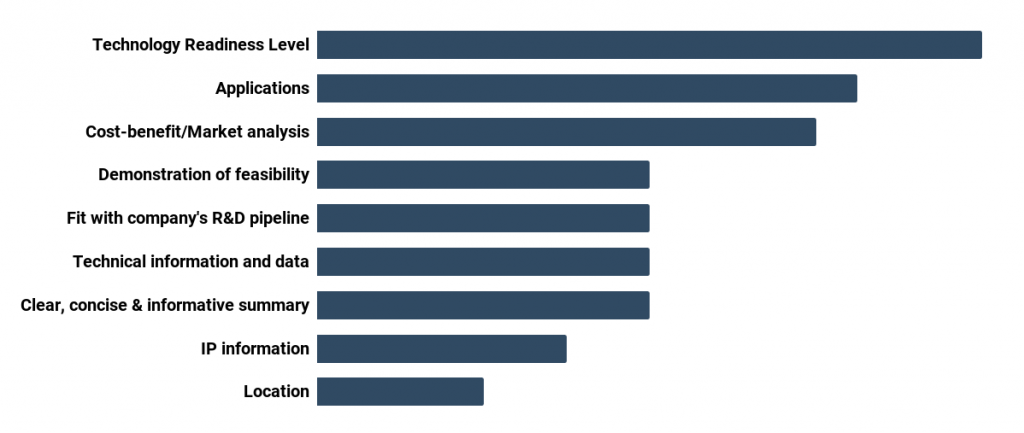

To better understand what information is essential to include in a technology disclosure, in our annual survey we asked the R&D professionals who use IN-PART: ‘What is the most valuable piece of information for your assessments of whether a breakthrough or new technology from academia is relevant to your company?’. Three key elements came up in almost all of the responses we received (a full summary of the responses is included below):

Stage of development, or technology readiness level (TRL)

Explicitly stating the project’s current stage of development gives R&D teams an indication of how much — if any — work is required to incorporated it into the company’s R&D pipeline. It also allows the R&D team to assess whether they have the capacity to invest in testing/validation, prototyping, and further development.

Collaborating with a university requires a significant investment of time and resources for a company. Given the right opportunity, it’s worth the investment, but an academic breakthrough might be dismissed outright without the essential information about its stage of development.

Potential applications

For an invention to progress to being an innovation it has to be applied to create, or be implemented into, a product that holds market appeal. This potential is key to the decisions taken by R&D teams to in-license a technology, or to collaborate with the university to further develop the innovation.

Although academic researchers might be looking for companies to designate their own specific applications for their breakthrough, we have found that R&D teams like to see some sort of vision for the technology in its final form, with suggestions about how the technology might be used in those applications.

Cost-benefit and market analysis

What makes a new technology or breakthrough advantageous over an existing one? We learnt that providing an indication of the competitive landscape is essential to make it clear how a new breakthrough offers technical benefits over currently available technologies. In addition, giving a brief, informed indication of the market demand and economic value of a technology provides an incentive for R&D professionals to take the time to evaluate an opportunity further. Also, R&D teams can sometimes be willing to shift focus from their core interests if it’s clear for them to see the potential economic value of the technology for their company.

The requirement to outline the benefits of a new technology over an existing one, and to provide an economic analysis, was also highlighted in a blog that we published earlier this year: ‘How do R&D teams evaluate new opportunities?’.

Ronan Bellabarba, Technology Manager at Johnson Matthey, an industry leader in speciality chemicals and sustainable technologies, outlined this outlook, saying that:

“There are certain critical points of information which are necessary to establish relevance. These are obviously the fit with my company’s existing, or potential, technology and markets, but also what problem does the technology solve, and how is this better than existing solutions?”

“The critical point for an initial evaluation is to have some kind of economic comparison against the leading competing solution to that problem. The ‘hook’ that gets a company interested is often presented as technical, but needs to be commercial; it also has to be credible. These calculations are not difficult but increase the impact by orders of magnitude.”

What else does industry want to know?

As the responses to our survey show (below), there are other pieces of information that are essential for R&D teams in industry. Making it clear exactly what the technology, project or breakthrough is, with a concise and informative title, and a description that ticks all the boxes means that R&D professionals can make a clear decision about its relevance to their work. This also helps IN-PART’s research team to more accurately match the breakthrough to the widest range of companies with aligned R&D interests.

R&D professionals also value seeing key technical details and data that demonstrate the feasibility or proof-of-concept of a technology. Including the intellectual property (IP) status and links to any patents can make the difference between the company taking the time to look into an opportunity and immediate dismissal.

Figure 1: IN-PART survey responses — ‘What is the most valuable piece of information for your assessments of whether a breakthrough or new technology from academia is relevant to your company?’ [January 2019, open question, 63 respondents]

Top tips for effectively communicating science to industry

Getting across all this information in a succinct, simple and engaging way for a global audience that might include non-specialists is not a small ask, but there are steps that can be taken to increase the chances of success. Briefly outlining the who, what, where, why, and how in the introduction is an effective way to cover much of the essential information required, followed by an expansion on these points through the rest of the technology disclosure.

Creating a story is a proven way to optimise engagement with scientific research. Writing about why the researchers have been working to develop a much-needed solution, and how they’ve been doing that, highlights why it’s also worth the time of passing R&D professionals.

If there’s an analogy that can be found with a global reference point, this can also cut down the words needed to describe a concept and quickly get across the gist of a complex idea. For example, you might describe a new drug delivery system for a tumour-targeting immunotherapy drug as a trojan horse to fight cancer, or you might summarise the AI-algorithms behind a reasoning engine for massive datasets as a Google Maps for decision making.

Adding links to further information is useful for keeping the summary short. The adage that a picture speaks a thousand words is often true. A video can say even more.

Finally, it’s important to keep in mind that it’s not necessary (and often unfeasible) to try and provide every detail about a project in 400–600 word summary. Providing the minimum essential information to capture enough interest from an R&D professional to ask further questions is a smart way of encouraging a request for more information that opens the door to a productive discussion.

Examples of successful technology disclosures on IN-PART

The following innovations are a select handful from the 230+ universities and research institutes using IN-PART that have received high levels of engagement from industry. They’re great examples of different approaches to providing a succinct summary of a project that successfully incorporates why the research is needed, how that’s been achieved, and what its future potential could be.

Exactly what the technology is and how it works has been clearly stated, and the all-important potential applications are outlined. Additionally, figures to illustrate key data, and links to further information such as publications and patents are included:

- Coating Mild Steel with Graphene for Corrosion Protection (Monash University)

- Anti-CCR6 mAb for Autoimmune Diseases (Monash University)

- Live-Attenuated Salmonella enterica Vaccine (North Carolina State University)

- Ultra-high Temperature Ceramics (University of Birmingham)

Written by Sharon Gill from IN-PART’s Research Team.

Edited by Alex Stockham, IN-PART’s Communications Manager.